Gold Posts Longest Run of Weekly Losses in More Than a Decade

Gold futures capped the longest run of weekly losses in 12 years as investors flee bullion-backed funds on bets stronger economic growth will bolster the Federal Reserve’s case to raise U.S. interest rates.

A rebound Friday wasn’t enough to avoid a seventh weekly decline, the longest stretch since May 2004. The central bank indicated last week it may raise rates three times in 2017, moves that could be bolstered by a report Thursday showing the U.S. grew at the fastest pace in two years. Holdings in exchange-traded funds backed by bullion fell a 30th day.

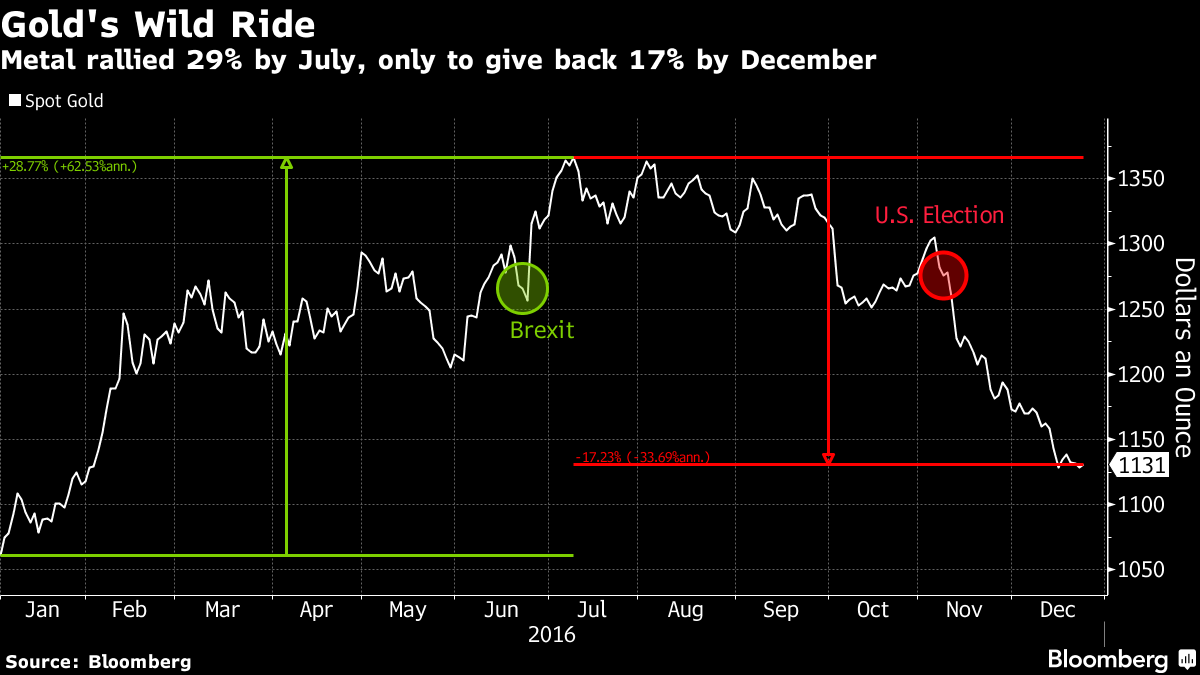

It was an erratic year for gold, with the biggest first-half rally in almost four decades giving way to a retreat as focus shifted from political uncertainty on the Brexit vote to U.S. monetary policy. Holdings in ETFs have shrunk continuously since Donald Trump won the U.S. election, fueling optimism fiscal stimulus will energize the economy and driving a gauge of the dollar to the highest levels since at least 2005.

Gold for immediate delivery declined 0.2 percent this week, also marking a seventh weekly decline, the longest stretch since August 2015.

Holdings in ETFs declined 3.92 tons to 1,779.3 tons on Thursday, extending the longest run of declines since September 2004.

Traders are pricing in a 74 percent chance of a rate increase by June, following the Fed’s 25 basis point hike this month.

- Silver futures for March delivery -0.7% to $15.759/oz on Comex

- Platinum futures for April delivery -1.5% at $895.00/oz on New York Mercantile Exchange

- March palladium futures -0.3% to $654.85/oz on Nymex

No comments:

Post a Comment