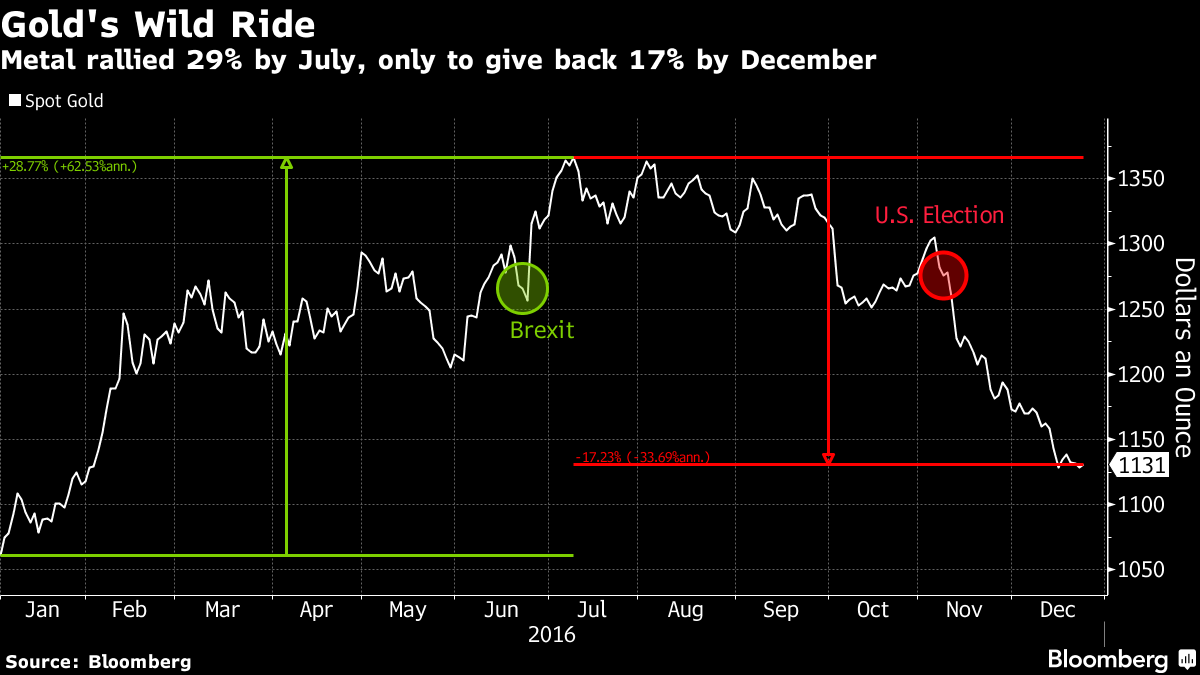

A "bullish thesis" that drove the gold price up by almost a third earlier this year is "dying if not already dead", says

Daily FX.

Gold

had been at the $1,050 mark at the beginning of the year but turned

higher two months later, in the middle of a wider market meltdown and as

the Federal Reserve relaxed its outlook for US interest rates.

It

went on to surge 31 per cent and even last month was still one of the

best-performing assets of the year, with prices up around a fifth.

But

last week, the Fed raised rates for the first time this year and

delivered its most bullish forecast for some time, setting out plans for

three further increases in 2017.

This caught the market off guard

- traders had expected the increase but thought the medium-term

forecast would be more circumspect, due to the uncertainty over

president-elect Donald Trump's likely effect on the US economy.

Instead, there is a general sense that a massive bout of promised infrastructure spending will fuel a surge in inflation.

All

of which is bad news for gold, which does not offer an income yield and

so loses out to peers that do when rates are rising. It is also

sensitive to the resulting jump in the dollar, which hit a 14-year high

this week.

So, gold fell – sharply, losing more than $20 an ounce

immediately after the announcement to below $1,140 and then falling as

low as $1,122 last night, a ten-and-a-half month nadir.

Daily FX

predicts support is currently being found around $1,125, a level at

which traders believe it is oversold, and so it proved, with a rebound

this morning taking the gold price to $1,134 an ounce.

If gold falls further,

there is another technical marker at $1,112,

a close below which prices might then slide to $1,100. Any rebound is

now also expected to run out of steam at around $1,150, well below the

level before this week's rates rise.

"The effect of the Fed has been huge," Jiang Shu, chief analyst at Shandong Gold Group, told

Reuters. "We see at least two rate hike in the first half of 2017 and [gold] prices are going to be lower for a while."

Gold price plunges below $1,140 after Fed rates surprise

15 December

Gold

plunged in afternoon trading in New York yesterday, after the Federal

Reserve caught traders off guard with its latest interest rates

decision.

The US policymakers voted unanimously to increase base

interest rates by 0.25 per cent, to a between 0.5 and 0.75 per cent -

the first rates hike this year and only the second in the past decade.

It

was a widely expected move, with traders putting the chances of an

increase at 100 per cent immediately before the announcement, based on

market bets via federal fund futures,

Bloomberg reports.

But "it was the Fed's more hawkish stance regarding rate hikes next year that surprised the market," says

Investing.com.

The

policymakers now forecast they will vote to increase interest rates

three times next year, up from the two predicted in September and a sign

of confidence in the US economy.

The news brought spot gold,

which had been around $1,164 an ounce, plunging to a ten-month low of

$1,141 by the end of US trading. It dipped to below $1,138 an ounce this

morning.

According to

The Guardian,

Fed chairwoman Janet Yellen told reporters: "It's important for

households and businesses to understand that my colleagues and I have

judged the course of the US economy to be strong.

"We have a strong labour market and we have a resilient economy."

Stephen Innes, a senior trader at Oanda in Singapore, said in a note that "this is

flat out hawkish", adding: "The market had expected at most a subtle shift in Fed language."

Yellen also said the US economy had added 2.25 million jobs in the past year and that the Fed now sees

growth next year of 2.1 per cent, up from a previous forecast of 1.9 per cent.

Analysts

speculate the prospect of "Trumpflation" - a surge in inflation

following a promised burst of spending by president-elect Donald Trump -

could also be prompting the bank to pre-emptively increase interest

rates.

While this boosted the dollar to a 14-year high, commodities such as gold and oil, which are priced in dollars, fell.

Rising

rates tend to make gold less attractive relative to income-yielding

peers. It is also more generally negatively correlated to the US dollar.

Gold price down ahead of Fed rates call

13 December

The

gold price was down in London trading today, hovering below $1,160 an

ounce and near a nine-month low ahead of a meeting of the US Federal

Reserve starting today.

Policy-makers will

decide on Wednesday evening whether to increase interest rates, with

the consensus being they will hike them for the first time this year.

Rising

rates are generally bad for gold as they increase the opportunity cost

of holding the non-yielding metal versus other income-generating assets.

They also tend to galvanise the already-strong dollar, against which gold is often held as a hedge.

The Wall Street Journal

reports that an increase has been widely expected since the market

bounce following the election of Donald Trump and amid hawkish comments

from rate-setters in recent weeks.

Many analysts think "that a rate hike [is] already priced into the market".

That would suggest a rise would not push gold much lower than its current level and opens the possibility for gold to surge should the Fed not increase them.

On

the other hand, Nitesh Shah, a commodities strategist at ETF Securities

in London, said investors will "look ahead to clues on the timing of

future rate hikes in 2017".

The

Fed will publish a "dot plot" of rate-setters' forecasts in the coming

12 months. If this suggests the pace of increase could pick up with

several rises next year, gold could fall sharply.

Gold price 'will slide to $1,100 in 2017'

1 December

Gold endured a fresh bout of selling overnight and in the process clocked up its worst month for three years.

Prices

at the end of the New York trading session, the last of November, were

down 1.4 per cent, leaving the metal down eight per cent for the month

as a whole – its worst performance since June 2013.

Mining.com says gold has "now trimmed its year to date gains to 9.8 per cent".

Initial

fears over the impact of a Donald Trump presidency on the global

economy have given way to speculation on the inflationary effects of his

investment plan, boosting the dollar and bringing pressure on gold.

Interest

rates could rise to counter a surge in inflation, which would hurt the

non-yielding metal. Traders give a 99 per cent chance of a rise being

announced at this month's Federal Reserve meeting, says the

Wall Street Journal.

Prices

were still tumbling in Asia this morning, hitting $1,163 an ounce and

the lowest level since the beginning of February. Gold had recovered

only slightly to $1,168 in London by mid-morning.

The latest move

lower came after another surge in the dollar, which reached nine and a

half-month highs against the Japanese yen after the Opec deal to cut

supply lifted oil prices and added to the sense that inflation is set to

soar, says

Reuters.

Gold is treated as a pseudo-currency and a hedge against the dollar, so the two tend to move in opposite directions.

"From

an investor point of view there is little reason to hold gold," said

Georgette Boele, a currency and commodity strategist at ABN Amro.

Technical

analysts believe having broken below $1,170, gold could now test the

next "resistance" level at $1,150 an ounce. ABN Amro predicts the price

will fall to $1,100 next year.

One issue on the horizon that could

turn the selling tide is the Italian constitutional referendum this

weekend. A No vote rejecting a series of changes to the political system

is expected to bring down Mario Renzi's government and trigger renewed

global uncertainty.

Uncertainty tends to push investors to safe havens such as gold, so the metal could see a short-term bounce.

Gold price nears ten-month low and could fall to $1,150

24 November

The gold price closed in on its lowest level for ten months yesterday, hitting a nadir of $1,180 before recovering slightly.

Having

fallen in excess of ten per cent from a brief post-US presidential

election high of $1,337, the precious metal remains under pressure ahead

of an expected increase in US interest rates next month.

New

figures show spending by US companies grew 4.8 per cent last month, its

biggest gain in a year. Coupled with recent strong labour reports and

positive rhetoric from policymakers, this has convinced traders

borrowing costs will rise in December, with market bets putting the

likelihood near 100 per cent.

Looking into next year, markets are

booming on the back of speculation that a spending splurge by incoming

president Donald Trump will fuel a rapid rise in inflation, while the

dollar is at a 14-year high.

A spike in inflation would hurt

non-yielding gold if it triggers even more rapid rate rises. The boost

in the dollar is biting now as gold is often held as a hedge against the

US currency.

Trading today has been thin and US markets are on

holiday, leaving the gold price standing at $1,185 an ounce. So where

does it go from here?

DailyFX

is still pointing to a technical marker of around $1,171 an ounce and

says if this is breached, the price may "target" the next foothold

lower, at $1,152.

If the market rebounds, however, and gold moves

back above $1,200, traders should look for resistance at another

technical indicator around $1,234 an ounce.

Gold price is 'getting slammed' below $1,200

23 November

The

gold price is "getting slammed" on a stronger dollar and ever-greater

certainty that the US Federal Reserve will increase interest rates next

month, says

Business Insider.

Gold

was holding within its narrow range above $1,210 an ounce after Asian

trading this morning, but it has since plummeted by more than $25 to

around $1,185.

This is the first fall below the important $1,200

threshold since February and marks a sharp 11 per cent reversal from a

peak of $1,337 an ounce in the wake of Donald Trump's US presidential

election triumph earlier this month.

Uncertainty over the incoming

president's economic agenda was expected to propel the metal on,

perhaps to $1,500. However, it has confounded analysts by slumping while

equity markets soar to new record highs.

It's not just a risk-on

move that is hurting the "safe haven": a pledged $1trn (£800bn)

infrastructure spending boost could send inflation soaring, prompting an

interest rate rises in response.

The Fed is expected to hike

rates for the second time in a year next month following more strong

economic data showing US companies are continuing to increase spending.

Gold

tends to do badly when interest rates are rising because, as it does

not provide any income, it carries a high opportunity cost. Rising

inflation and rates expectations are also boosting the dollar, against

which the metal is held as a hedge.

Prices could fall further from

here, with analysts having previously highlighted a technical

resistance level around $1,170 as a target.

Nevertheless, Robin Bhar,

the head of metals research at Societe Generale in London, said there

was a chance gold might bounce back in a "sell the rumour, buy the fact"

rally if the Fed does act next month.