https://quoththeraven.substack.com/p/ben-bernanke-winning-the-nobel-prizeBen Bernanke Winning The Nobel Prize In Economics Is A Sick Joke

The man who failed to see the 2008 crisis in advance is being heralded for his "economic research". 14 years later, we are still paying the inflationary & moral hazard cost for his "solutions".

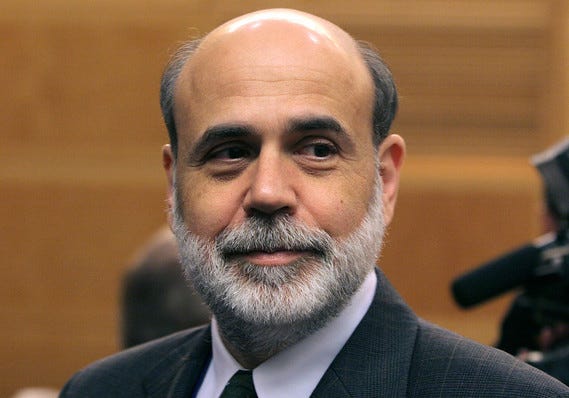

As most everybody knows by now, former Federal Reserve Chairman Ben Bernanke has won the Nobel Prize in Economics:

On October 10th, The Royal Swedish Academy of Sciences awarded the Sveriges Riksbank Prize in Economic Sciences in Memory of Alfred Nobel 2022 to Ben Bernanke for his groundbreaking research on banks and financial crises.

The Nobel Prize’s website reads:

The Great Depression of the 1930s paralysed the world’s economies for many years and had vast societal consequences. However, we have managed subsequent financial crises better thanks to research insights from this year’s laureates. They have demonstrated the importance of preventing widespread bank collapses.

Let’s stipulate that despite Ben Bernanke’s history as a professor and chairing the economic department at Princeton, the most prominent, well-known and meaningful part of his career was as 14th chairman of the Federal Reserve, a position he held from 2006 to 2014, a period when he oversaw one of the greatest financial crises in global history.

Now, let’s have a look at how the Nobel Prize selects its winners. According to the Nobel Prize’s website, the criteria for the award is supposed to be based on the “greatest benefit to humankind”:

“Every committee is slightly different but ultimately they all work to fulfil the will of Alfred Nobel which stated that the Nobel Prize should be awarded according to those who have “conferred the greatest benefit to humankind.”

First, let me play devil’s advocate, because the question about Bernanke’s track record as Fed Chair boils down to the question of being proactive with preventative measures versus being reactive with a solution.

Though I’m not a mind reader and certainly not the smartest person in the world, I think I know what people who support the job Bernanke did are thinking: a massive, unavoidable crisis took place on his watch and he was the one able to take whatever measures necessary to get the country, and the global economy, back on its feet and moving forward.

In that regard, they are correct. He did oversee a massive crisis and, in the years following it, was able to give the appearance that the economy and markets had returned to normal.

But in the years leading up to the crisis, Bernanke showed poor aptitude, at best, in understanding both the warning signs and policy dynamics that created it.

“…there’s not much indication at this point that subprime mortgage issues have spread into the broader mortgage market, which still seems to be healthy. And the lending side of that still seems to be healthy.” - Ben Bernanke, February 2007

While some economists warned on national financial media that a bubble was forming in housing, Bernanke continued to insist, on various mediums and in front of Congress, that all was well and good with both the economy and the housing market.

Consider the below chart, courtesy of Yale Business School, which shows turmoil in the second half of 2007 in the credit default swap market and the Libor-OIS spread.

It shows stress beginning in August 2007.

The beginning of that stress was just about one month after Ben Bernanke publicly proclaimed that the fundamentals of the global economy were strong.

“The global economy continues to be strong, supported by solid economic growth abroad. Overall, the U.S. economy seems likely to expand at a moderate pace over the second half of 2007, with growth then strengthening a bit in 2008 to a rate close to the economy's underlying trend.” - Ben Bernanke, July 2007

Bernanke forecasted in July 2007 that the U.S. economy would strengthen in 2008. It was just one year after this prediction that the country, and the world, was on the doorstep of a “worst case scenario” for global markets: a systemic collapse.

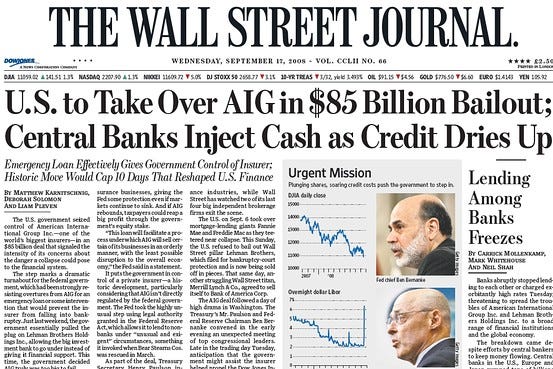

September 2008 also saw the largest failure in U.S. banking history, followed by the beginning of massive Central Bank-led bailouts.

It sure seems like a far cry from a “strengthening economy”, but what do I know?

Bernanke then oversaw and helped implement the easiest possible solution at the time: the continuation of an unprecedented experiment in monetary policy manifesting as a bailout totaling $475 billion, of which $250 billion went to stabilizing banking institutions, $82 billion went to the U.S. auto industry and $70 billion went to insurer AIG.

The bailout was, in essence, a reward for companies that were so mismanaged they, or their entire sectors, would not be able to withstand market forces at the time. And while there were some political negotiations necessary to make it happen (at least, the appearance of negotiations), it still amounted to a very blunt tool, used in a panic, which carried with it both short-term and long-term consequences for the everyday American.

In the short-term, millions of Americans still lost their jobs, retirement savings and homes while banks got billions in “free money”. In the long-term, it created moral hazard that led to our current inflationary crisis, a product of the deeply flawed idea that the Fed has, to use Neel Kashakari’s parlance, “infinite” money.

Get 50% off: Today’s post is free, because I feel the content is too important to place behind a paywall. If you enjoy this article, would like to support my work and have the means, I would love to have you as a subscriber and can offer you 50% off for life:

Now, let’s talk about proactive versus reactive thinking. Is it fair to say that Bernanke was only reactive to an issue he created by failing to be proactive in seeing the signs?

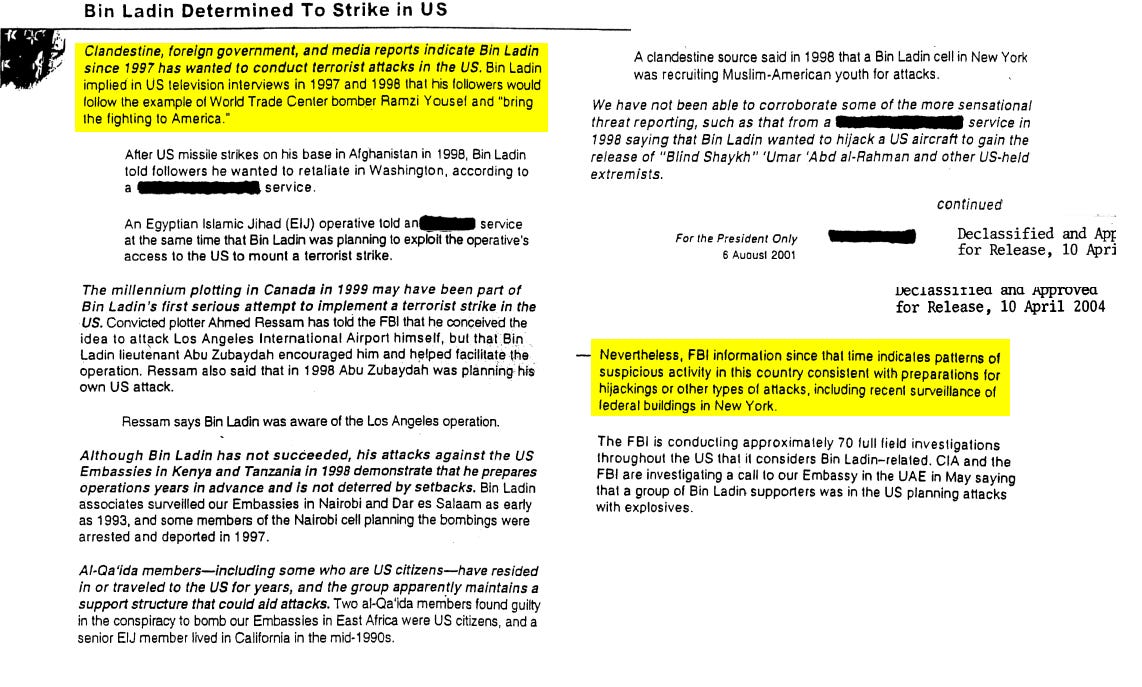

This is an argument that comes up all the time when people talk about the 9/11 attack.

Politicians like then-NYC Mayor Rudy Giuliani and then-President George W. Bush often tout that they kept the country safe while they were in office, in the wake of the 9/11 attacks. This is one of my biggest pet peeves because it ignores the fact that the attacks happened while they were in office.

And not unlike credit spreads blowing out in August 2007, a year before the “shit hit the fan” for the economy, President Bush had his own warning in August 2001, one month before the 9/11 attack.

Bush’s warning, a memo from the CIA that was literally called “Bin Ladin Determined To Strike In US”, specifically mentioned the World Trade Center and hijacking aircraft. The attacks took place about a month later. Does this mean George W. Bush kept the country safe on his watch? That’s up for debate.

This line of thinking – expecting our elected leaders to proactively address a problem, is often disregarded as “Monday morning quarterbacking” or isn’t talked about at all when it comes to issues like September 11 because of the emotional nature of the discussion.

For example, while debating the merits of the Bush family and the Iraq war in 2016, then-Presidential candidate Jeb Bush claimed that his brother kept the country safe by building a “security apparatus”. In response, Donald Trump pointed out that the 9/11 attacks actually took place on George W. Bush’s watch.

Jeb was arguing the virtues of being reactive while Trump was arguing the virtues of being proactive. Trump was booed, Jeb was applauded.

The same response holds true for Ben Bernanke. If you want to crown him for his reaction to the global financial crisis, that’s one thing.

But does his lack of proactive thinking and total negligence in understanding the situation before it occurred really qualify him for a Nobel Prize?

Additionally, could it be any more tone deaf to award Bernanke the Nobel Prize in 2022, as the entire world is grappling with an inflation crisis?

Ben Bernanke was a key figure in creating the moral hazard and the ethos on Wall Street that not only signaled to bankers that they can be reckless because bailouts are a guarantee, but also provided positive reinforcement for the idea of endless money printing as acceptable monetary policy.

The crisis our Fed is fighting now is the consequence of the theories that Bernanke utilized, advocated for, and then masturbatorily congratulated himself for in a book that talks about how the Fed Chair offered up a courageous stroke of his brilliance when we needed it most.

Again, supporters will argue that Bernanke staved off the largest economic collapse in history. But today moreso than ever, we should be asking: at what cost?

Billions of people worldwide are in the midst of watching their quality of life deteriorate at the hands of inflation. You can draw a straight line directly from Bernanke’s quantitative easing policies to this crisis.

In fact, Bernanke made his stance on this type of monetary policy clear all the way back in 2002, when he heralded the idea of printing money as “technology”, and said the government can do so “at no cost”.

"The U.S. government has a technology, called a printing press (or today, its electronic equivalent), that allows it to produce as many U.S. dollars as it wishes at no cost." - Ben Bernanke, Nov. 21, 2002

But we know now that this thinking was flawed deeply. We are now living the “cost” in the form of one of the greatest inflationary shocks in the country’s history.

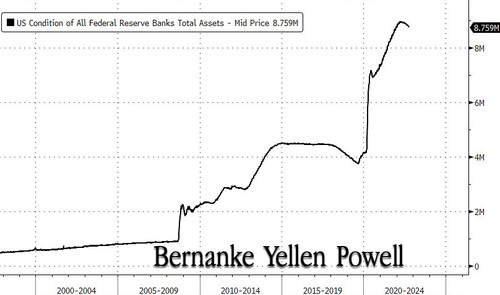

And as Zero Hedge noted more “cost” this week in the form of a Central Bank balance sheet that is unable to, and never will, meaningfully shrink in size. In short, the Fed is stuck in a corner they can’t get out of and it’s only a matter of time until something enormous breaks again as a result. The site notes that at the time Bernanke was Fed chair, “the Fed's balance sheet was approaching $2.5 trillion.”

“Multiple rounds of money printing later and a massive expansion during the Covid crisis, the balance sheet stands at around $9 trillion today,” they write.

Does today’s inflationary crisis mean Ben Bernanke deserves a Nobel Prize in Economics for doing “research”?

It comes back to the old expression: “you had one job to do”.

The Federal Reserve’s dual mandate is "maximum employment, stable prices, and moderate long-term interest rates”. In addition to Americans still enduring the shock of 2008’s policy thinking, none of the Fed’s stated goals even occurred during the first several years of Bernanke’s tenure.

If you want to subscribe to the Keynesian model, the job of the Fed Chair is to help minimize busts and slow down booms. Arguably, if a Fed chair is doing their job correctly, nobody should even notice. That means no one should be writing books about it and no one should get “famous” from being Fed Chair.

But where’s the political value in that?

And how are former Fed chairs expected to make millions of dollars per year in “speaking fees” if they don’t make a name for themselves?

According to MarketWatch, that’s exactly what Ben Bernanke did, receiving $250,000 to speak at an event in Abu Dhabi as soon as he was out of the Fed.

“With one speech, Bernanke exceeded his $199,700 annual salary as Fed chairman in 2013,” MarketWatch wrote.

Forbes noted that former Fed Chair Janet Yellen has also made millions in fees from banks and large companies:

Janet Yellen, President-elect Joe Biden’s nominee for treasury secretary, has earned more than $7 million in speaking fees from banks and large companies since leaving the Federal Reserve in 2018, a record that will force Yellen to seek permission before working at Treasury with some of Wall Street’s largest financial institutions.

Can you see the feedback loop yet? The Fed capitalizes banks (gives them money and prevents them from failing), and the banks turn around and stuff millions of that very same cash back into the pockets of the Fed Chair that helped it happen.

Meanwhile, policies supported and utilized by Bernanke have caused the moral compass of the financial world to completely deteriorate once again. The moral hazard has even bled into government and politics in ways we’ve never seen before.

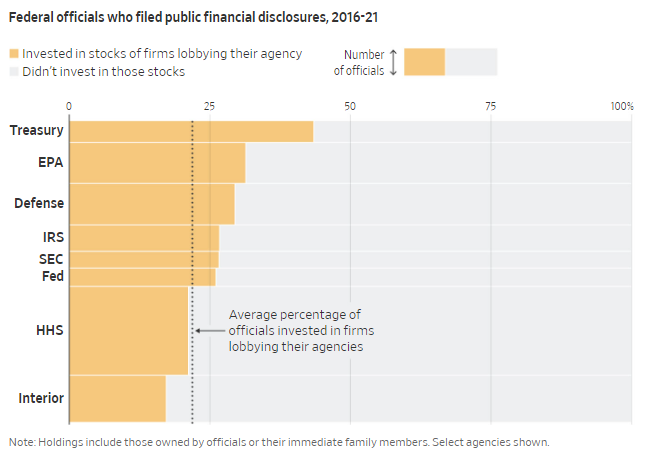

For example, a brand new report out of the Wall Street Journal on Tuesday analyzed “more than 31,000 financial-disclosure forms for about 12,000 senior career employees, political staff and presidential appointees”.

It found that “more than five dozen officials at five agencies, including the Federal Trade Commission and the Justice Department, reported trading stock in companies shortly before their departments announced enforcement actions, such as charges and settlements, against those companies.”

This comes just months after we found out that Fed officials were inappropriately trading all types of financial assets ahead of key central bank decisions.

In 2021, we learned:

The Dallas Fed’s Robert Kaplan was an “active buyer and seller of stocks” in 2020, per the Wall Street Journal. He is also to reported to have purchased and sold lots worth more than millions of dollars in S&P futures.

Jerome Powell owned millions of dollars in securities like municipal bonds that the Fed bought during 2020, per CNBC. “Fed Chair Powell owned the municipal bonds in question in a joint account over which he had control,” CNBC reported.

Boston Fed President Eric Rosengren “made frequent or substantial trades in 2020,” according to Reuters. Bloomberg expounded on Rosengren’s trading, noting that he dealt in REITs, trading not from a blind trust, that hold mortgage backed securities. CNBC also noted of Rosengren that he “held between $151,000 and $800,000 worth of real estate investment trusts that owned mortgage-backed securities. He made as many as 37 separate trades in the four REITS while the Fed purchased almost $700 billion in MBS.”

Vice Chair Richard Clarida sold assets in the days during the Covid panic, only to buy them back days later, hours before the Fed announced it would be stepping in to support markets. He stepped down in early 2022.

For an entity that is supposed to be objective, clinical and unbiased, I can’t think of any more grotesque behavior than what we have seen out of the Federal Reserve - and the behavior it has enabled in the financial world.

And in my opinion, this behavior all comes on the heels of our belief that the steps we took in 2008 in 2020 were the best options for our country and its citizens.

This time, with the Nobel Prize, it’s finally not just the central bankers sending false signals to the market. The Fed sent the wrong signal to Wall Street in 2008 and 2020, but now the Nobel Prize is sending a false signal to them, in the form of positive reinforcement as if they are doing something right, just and honorable.

This award likely now has former Chair Janet Yellen, current chair Jerome Powell and Fed Chair hopefuls like Lael Brainard and Neel Kashkari thinking they can not only print their way out of all economic problems, but also to personal global acclaim, praise and one of the most widely recognized honors on Earth.

In 2022, not only are prices up, but we have failed to deploy any economic leverage when we needed it most to try and sanction Russia. On top of that, the global economy is splitting in two before our eyes, with the BRIC nations (China, Russia, Brazil, India, Saudi Arabia) actively and openly mocking President Biden and making it clear they want to create a global reserve currency to challenge the U.S. dollar.

Maybe this wouldn’t be happening if we had spent the last 20 years focused on the soundness of our money supply instead of trying to defile the corpse of the dollar’s remaining purchasing power. Instead, we decided to play Romper Room and run unprecedented monetary policy experiments that have eroded our leverage globally, instead of bolstered it. Then, we congratulated ourselves for it.

If you ask me, Bernanke and his ilk have hardly left us at a place of financial stability and the idea that he - or anyone at the Fed in the last 20 years - deserves a Nobel Prize for Economic “research” is a sick joke.

No comments:

Post a Comment