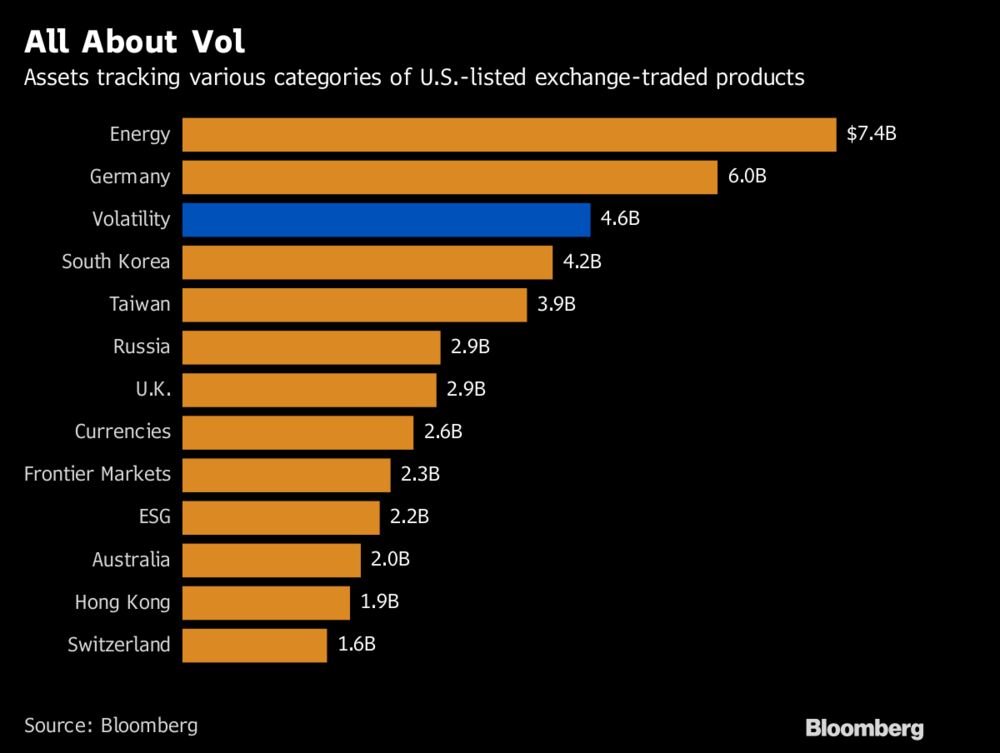

Even as the CBOE Volatility Index plunges to its lowest on record and U.S. stocks march to fresh highs, investors have continued to give the short-volatility trade their vote of confidence this year. With $2.4 billion in assets, short volatility exchange-traded funds are backed by the most cash on record, according to data compiled by Bloomberg.

The funds’ meteoric rise is to some degree a bet that the U.S. stock market will keep rising, since the VIX and S&P 500 move in opposite directions about 80 percent of the time. With the S&P 500 up 16 percent and at its highest on record, the $1.1 billion VelocityShare Daily Inverse VIX ETN has surged 141 percent, heading toward its best yearly performance in five years.

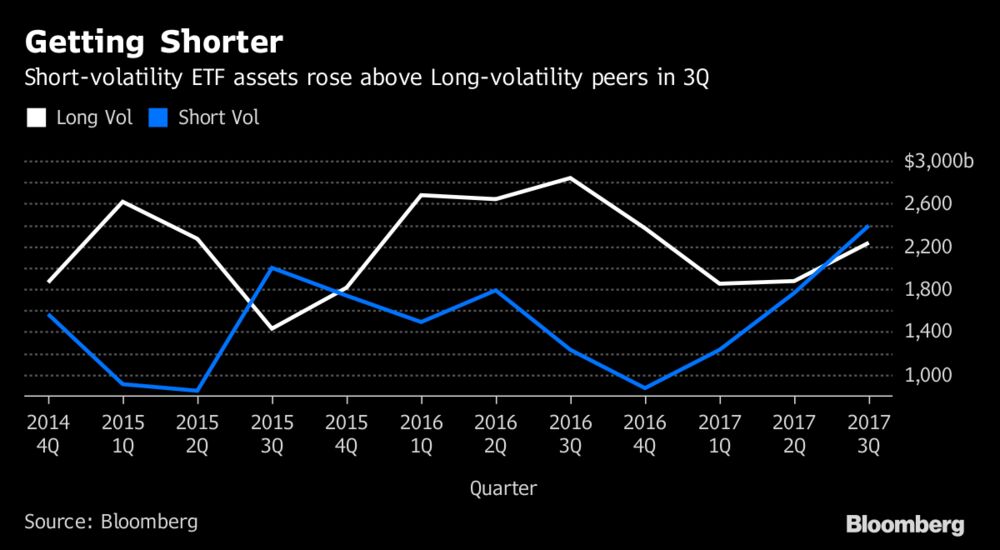

For now, the volatility bears have the momentum. Inverse VIX funds have nearly tripled in size this year alone. The amount of assets tracking short-volatility products rose above that of their long-volatility counterparts for the first time in two years in the third quarter.

No comments:

Post a Comment