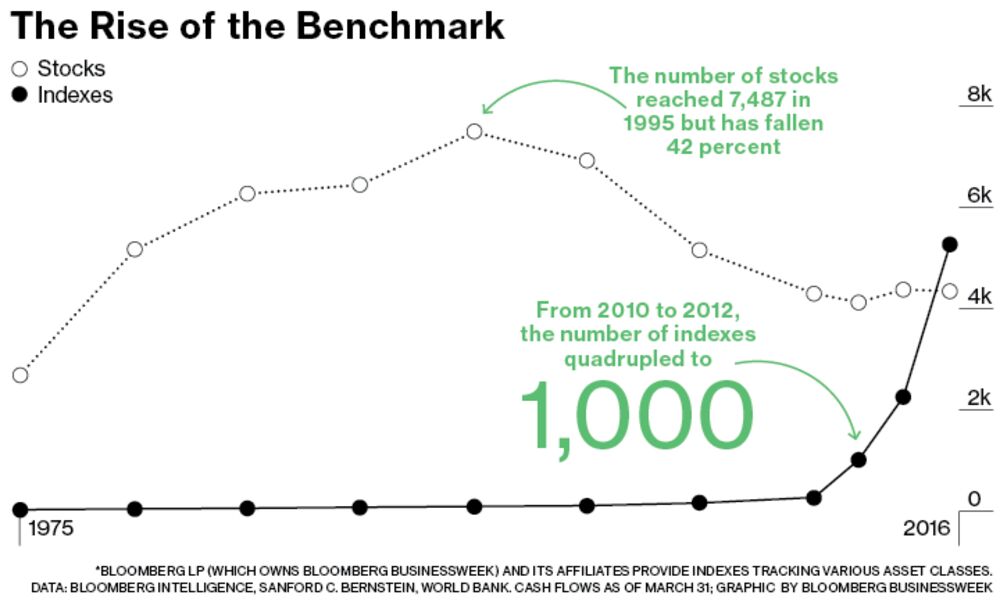

The number of market indexes now exceeds the number of U.S. stocks. Traditional ones such as the S&P 500 are collections of securities weighted by market value, and index funds mimic them as a low-cost way to deliver the market’s performance. Many new indexes are different: They include stocks based on custom criteria, such as having low volatility or high dividends.*

What drove the jump?

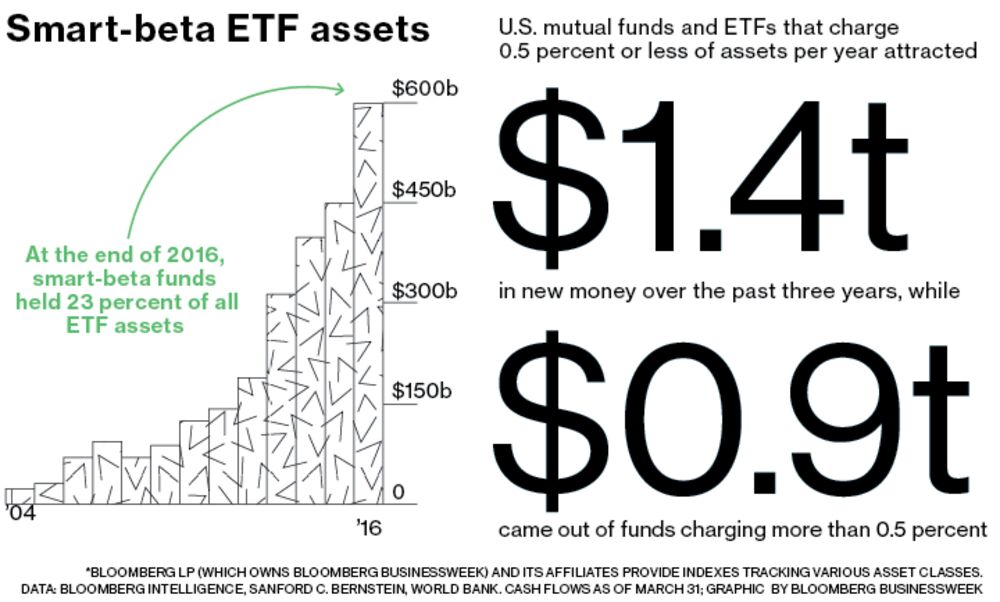

Demand. Many new benchmarks essentially repackage active investment strategies into indexes, says Eric Balchunas, senior exchange-traded fund analyst at Bloomberg Intelligence. They can then be tracked by so-called smart-beta ETFs, which fund companies are rolling out rapidly.Why so many new ETFs?

Money managers are under pressure to cut costs, says Balchunas, as investors shift their money into funds with low fees. Smart-beta ETFs are generally more expensive than S&P 500 funds but cheaper than actively managed funds. It remains to be seen how well the new funds will perform.

No comments:

Post a Comment