WPP Plc shares had their biggest drop in 17 years after the world’s largest advertising company cut its full-year revenue forecast amid lower spending by customers, in particular consumer-goods manufacturers.

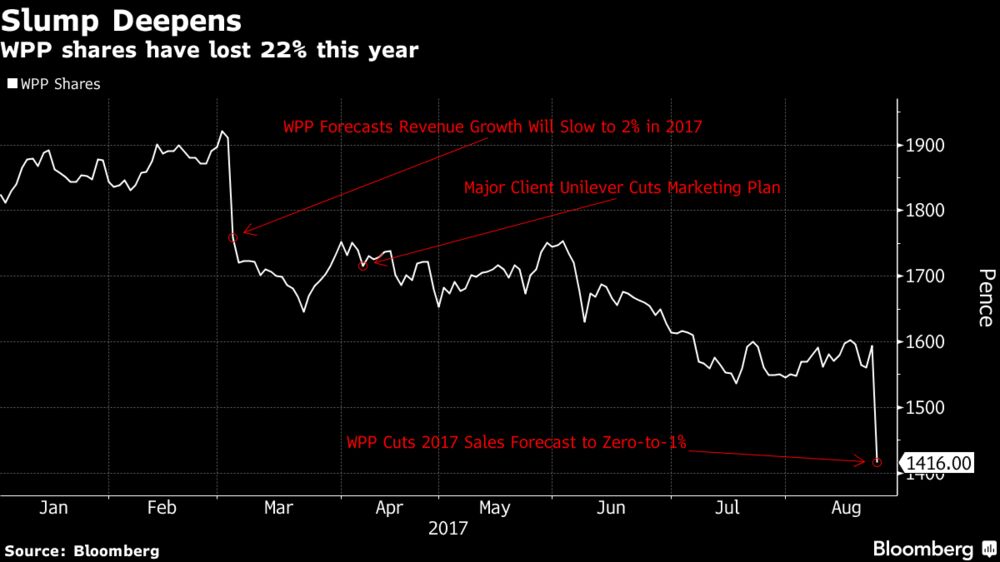

The stock fell as much as 13 percent after WPP said like-for-like revenue growth is expected to be between zero and 1 percent in 2017. That’s down from an earlier 2 percent forecast.

Advertising companies worldwide are being hit as big clients like Unilever and Procter & Gamble Co. focus on cost-cutting to cope with sluggish global economic growth and technological disruption. London-based WPP singled out ad spending on consumer goods -- items such as laundry detergent and toothpaste that make up about one-third of its revenue -- as coming under particular pressure.

Consumer-goods giant Unilever, one of WPP’s biggest customers, said earlier this year that it would cut ad output by 30 percent and halve the number of creative agencies it works with to 1,500 from 3,000. That followed a failed takeover bid by Kraft-Heinz, which was the “seminal” moment in the first quarter, according to WPP Chief Executive Officer Martin Sorrell.

“That sent a shock-wave through the industry,” Sorrell said by phone. “It obviously had an effect in terms of people spending, particularly in the packaged goods sector.”

Shares of WPP fell as low as 1,382 pence and were down 11 percent to 1,420 pence at 2:38 p.m. in London. Publicis dropped 2.9 percent in Paris, while IPG decreased 4.1 percent and Omnicom declined 4.2 percent in the U.S. Shares of European television companies including TF1, ProSiebenSat.1 Media SE and ITV Plc declined as well.

In March, WPP had its biggest drop since the financial crisis when WPP gave its initial forecast for 2 percent growth, the slowest pace since 2009.

In the second quarter, WPP’s like-for-like net sales fell 0.5 percent with July declining 2.6 percent, and North America and Western Continental Europe were the poorest performing regions.

“Some of the weakness was expected, however this is still an incremental disappointment,” Tamsin Garrity, an analyst at Jefferies Group, said in a research note.

WPP said that it didn’t experience any significant loss in revenue from clients or of data from a cyberattack it suffered in June. The attack took down WPP’s website and caused disruptions across businesses including the creative agency Ogilvy and Mather, a person familiar with the matter said at the time.

The attack cost WPP about $10 million, $5 million of which was covered by insurance, Sorrell said. The company will spend about $10 million to $15 million annually on increased protection against future attacks, he said.

Before it's here, it's on the Bloomberg Terminal.

LEARN MORE

No comments:

Post a Comment