After spending more than 50 years in foreign hands, Germany's gold is finally going home.

In a recent watershed decision the Bundesbank, Germany's central bank, has decided at least half of its gold should be held in its own vaults.

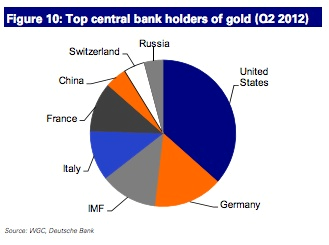

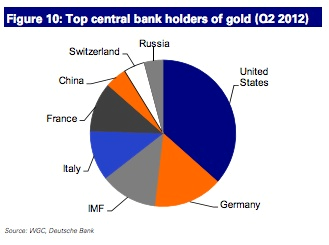

Since the Bundesbank is the second-largest gold holder in the world, that's going to mean moving 54,000 bars of the shiny metal.

So why does Germany want its gold back, and why now?

Part of it has to do with pressure from a grassroots group led by a group of economists, business executives, and lawyers, along with the German Precious Metals Association, who have put together a "Repatriate our Gold!" campaign.

But that's only part of the story...

In a recent watershed decision the Bundesbank, Germany's central bank, has decided at least half of its gold should be held in its own vaults.

Since the Bundesbank is the second-largest gold holder in the world, that's going to mean moving 54,000 bars of the shiny metal.

So why does Germany want its gold back, and why now?

Part of it has to do with pressure from a grassroots group led by a group of economists, business executives, and lawyers, along with the German Precious Metals Association, who have put together a "Repatriate our Gold!" campaign.

But that's only part of the story...

Official pressure began last October when the German Federal Court of Auditors requested an inspection of the gold Germany stores in foreign central banks.

That sparked something of a political controversy since these gold reserves have never been thoroughly inspected and audited.

What's more, the U.S. Federal Reserve had already refused to allow the Germans to verify their gold despite several attempts.

So why would the Federal Reserve deny the Bundesbank a full inspection and audit?

That question has been rich feed for the rumor mills ever since the news broke.

So let's have a closer look at the surrounding facts...

The Significance of the German Gold Repatriation

According to the plan, Germany's gold repatriation will take seven years to complete and by 2020, Germany will store 50% of its gold in Frankfurt. Several analysts consider that, since the gold will only be moving from one vault to another, this transfer will have no measurable market effect.But I think it's a mistake to make that assumption. Instead, this news could have a significant psychological impact.

Here's why...

Others will follow Germany's lead. The Dutch are already making similar noises, asking for an audit and full transparency. The Netherlands also only has 10% of their gold reserves at home, with the rest in New York, Ottawa, and London. Now it's only a matter of time before others start to ask the same kinds of questions. In a recent tweet, Bill Gross said what many are probably already thinking: central banks just don't trust each other anymore.

Growing concerns about the euro. There are suggestions Germany wants its gold because it's worried its loans to less fiscally responsible sovereigns won't be repaid. But I believe Germany is preparing in case the Euro were to eventually dissolve, so it wants its gold to potentially back a new Deutsche Mark. Perhaps they, too, recognize gold's return to its role as money.

A list of unanswered questions. The first is obvious: Is the gold really there? If so, why would it take seven years for Germany to get its gold back? Would you take the risk of collecting it slowly, or would you want it much faster? Some say the gold's there, yet others disagree. Steve Scacalossi, vice president and director, global precious metals at TD Securities, says Germany's gold is allocated, and therefore can't be lent out, so it will not affect gold lease rates.

Meanwhile, Keith Barron, a geologist and consultant responsible for one of the largest gold discoveries in 25 years, recently told King World News:

"I believe that most of the Western world's gold, which is supposed to be in central bank vaults, has been leased out. Much of it is now in private hands in India, and what remains continues going East to China and other Asian vaults. So most of the Western gold has vanished from the vaults and it's now just a book entry. These various Western countries and bullion banks simply roll these leases over when they come due, and the gold never gets returned back to the countries. So it's very interesting to see what's going on. Obviously the trust is breaking down in the system."

While some could easily dismiss Germany's behavior as that of a distrustful state, there's precedent for Barron's claims.

But it will take the Fed some seven years to procure Germany's 300 tons of gold. This is the same Fed that, in its own words, holds some "216 million troy ounces of gold" or some 6720 tons, in its vault 80 feet below ground level.

Putting the above in perspective, the amount of gold that Germany will have to wait 7 years for is shown in red. The amount of gold the Fed supposedly holds, is shown in yellow with a shade of tungsten. Why it will take the Fed 7 years to part with an amount of gold that is less than 5% of its total holdings is anyone's guess...

unless of course, the bulk of the gold in the column on the right has been rehypothecated numerous times to serve as collateral for countless counterparties, and it is no longer clear just who own what to anyone.

* * *

We can only wonder how many centuries it will take the New York Fed to deliver all the gold held by third parties in its vault, once the demand notices start rushing in...

No comments:

Post a Comment