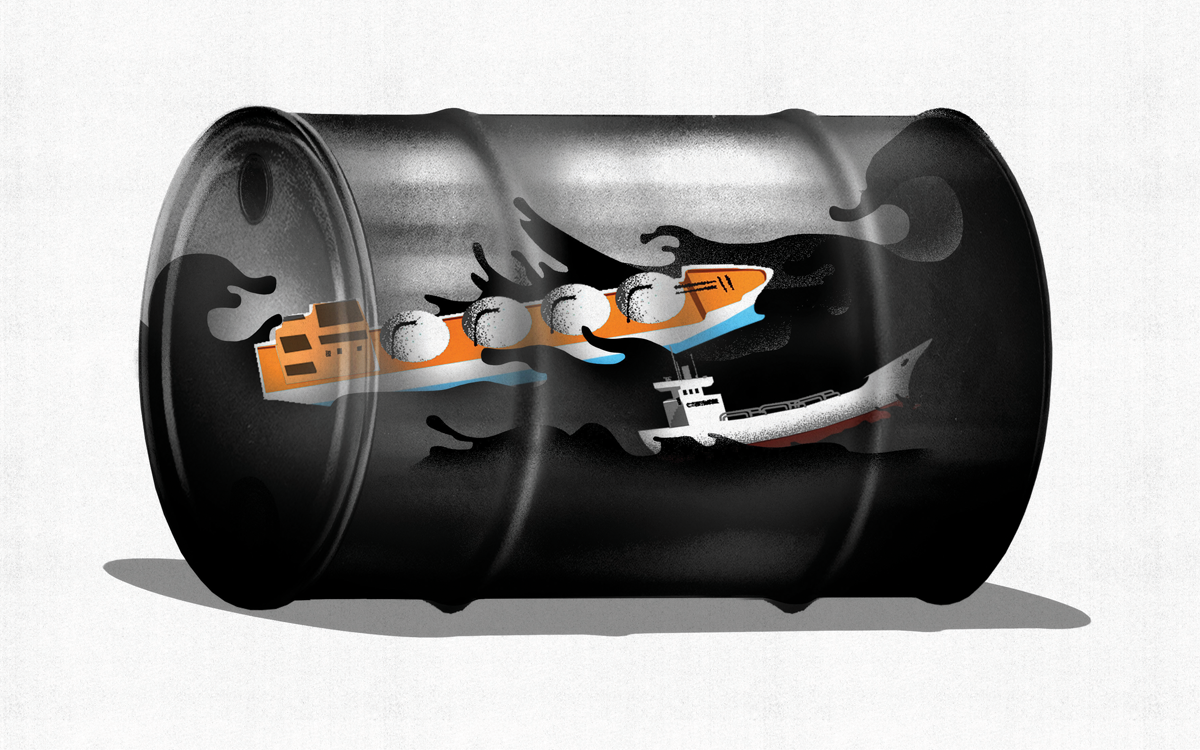

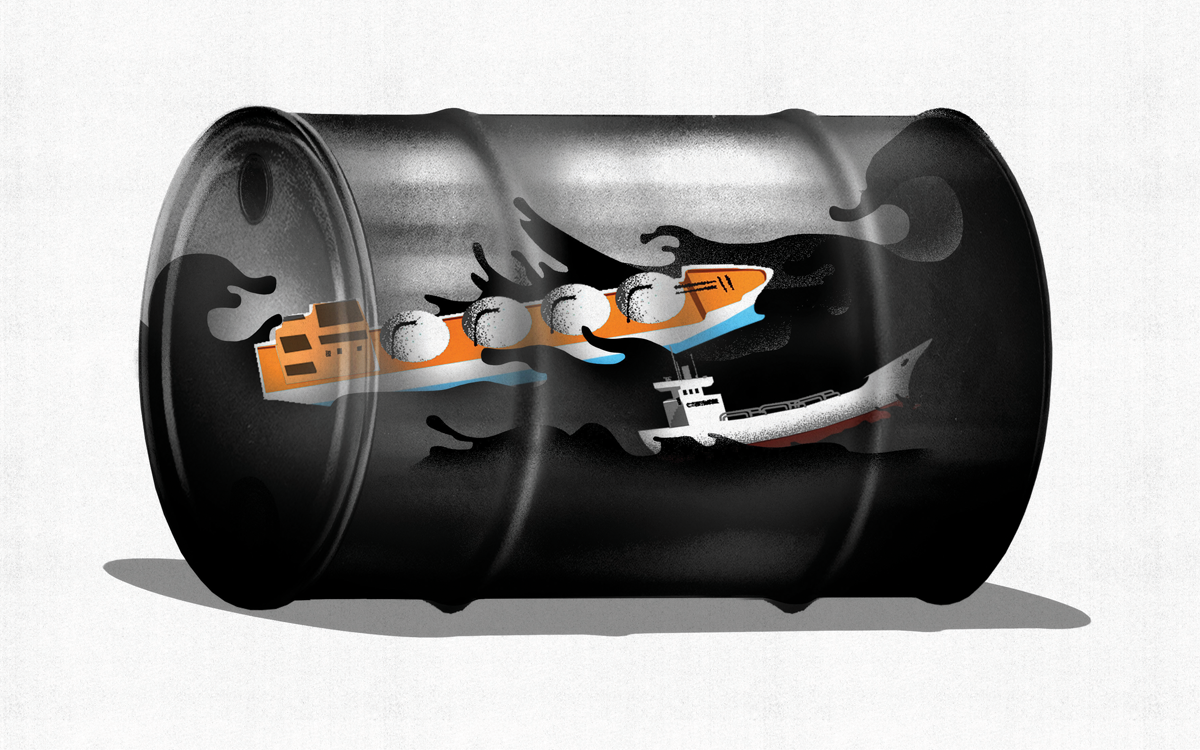

THIS PAST SPRING, coastlines around the globe took on the feel of an enemy invasion as hundreds of massive oil tankers overwhelmed seaports from South Africa to Singapore. Locals and industry analysts alike used the word armada—typically applied to fleets of warships—to describe scenes such as when a group of tankers left Saudi Arabia en masse and another descended on China. One distressed news article proclaimed that a “floating hoard” of oil sat in tankers anchored across the North Sea, “everywhere from the UK to France and the Netherlands.” In April, the US Coast Guard shared an alarming video that showed dozens of tankers spread out for miles along California’s coast.

On May 12, Greenpeace activists sailed into San Francisco Bay to issue a challenge to the public. In front of the giant Amazon Falcon oil tanker—which had been docked in the bay for weeks, loaded up with Chevron oil—they unfurled a banner reading, “Oil Is Over! The Future Is Up to You.”

The oil industry has turned the oceans into aquatic parking lots—floating storage facilities holding, at their highest levels in early May, some 390 million barrels of crude oil and refined products like gasoline. Between March and May, the amount of oil “stored” at sea nearly tripled, and it has yet to abate in many parts of the world.

This tanker invasion is only one piece of a dangerous buildup in oil supply that is the result of an unprecedented global glut. The coronavirus pandemic has gutted demand, resulting in the current surplus, but it merely exacerbated a problem that’s been plaguing the oil industry for years: the incessant overproduction of a product that the world is desperately trying to wean itself from, with growing success.

This tanker invasion is only one piece of a dangerous buildup in oil supply that is the result of an unprecedented global glut. The coronavirus pandemic has gutted demand, resulting in the current surplus, but it merely exacerbated a problem that’s been plaguing the oil industry for years: the incessant overproduction of a product that the world is desperately trying to wean itself from, with growing success.

Today, the global oil industry is in a tailspin. Demand has cratered, prices have collapsed, and profits are shrinking. The oil majors (giant global corporations including BP, Chevron, and Shell) are taking billions of dollars in losses while cutting tens of thousands of jobs. Smaller companies are declaring bankruptcy, and investors are looking elsewhere for returns. Significant changes to when, where, and how much oil will be produced, and by whom, are already underway. It is clear that the oil industry will not recover from COVID-19 and return to its former self. What form it ultimately takes, or whether it will even survive, is now very much an open question.

Under President Donald Trump, the United States has joined other petroleum superpowers in efforts to maintain oil’s dominance. While government bailout programs and subsidies could provide the lifeline the industry needs to stay afloat, such policies will likely throw good money after bad. As Sarah Bloom Raskin, a former Federal Reserve governor and former deputy secretary of the Treasury, has written, “Even in the short term, fossil fuels are a terrible investment. . . . It also forestalls the inevitable decline of an industry that can no longer sustain itself.”

In contrast to an agenda that doubles down on dirty fuels, a wealth of green recovery programs aim to keep fossil fuels in the ground as part of a just transition to a sustainable and equitable economy. If these policies prevail, the industry will rapidly shrink to a fraction of its former stature. Thus, as at no other time since the industry’s inception, the actions taken now by the public and by policymakers will determine oil’s fate.

The Greenpeace activists are right. Whether the pandemic marks the end of oil “is up to you.”

THE OIL INDUSTRY is in such dire straits today because of the multiple crises it has faced since well before the pandemic. These upheavals are largely the result of the decades of organizing that have cast a dark shadow over the industry and exposed the harms associated with oil. This advocacy has helped to shut down and delay fossil fuel projects through direct-action protest, bring about current and expected policies to cut demand and production, make sustainable transportation and renewable energy more accessible and affordable, and reduce the political and economic benefits of supporting the oil industry. The result of the organizing and advocacy is death by a thousand cuts, leaving behind an industry producing too much of a commodity that is of shrinking value.

For more than a decade, volatility has been a hallmark of global oil markets. Within extreme highs and lows, however, there exists a consistent trend: a fall both in oil prices since 2008 and in the growth of demand for oil since at least 2011. After reaching a record high of $148 a barrel in 2008, which helped spark the Great Recession, the price of a barrel of oil in November 2019 was just $60. The growth in demand for oil worldwide in 2015 was more than two and a half times greater than in 2019; it plunged precipitously between 2017 and 2019. Despite the contraction in demand, companies kept pumping larger amounts of oil. By 2018, the global oil supply had outstripped demand, causing a glut. The situation was dire enough that the research consulting firm McKinsey & Company warned oil-producing nations in 2019 to begin “sufficiently diversifying their economies for a post-[oil] peak demand world.”

Corporate profits and market values, as well as investor returns, have been in a nosedive. Between 2012 and 2017, the oil majors’ profits collapsed. BP’s profits dropped by 68 percent, Chevron’s by 65 percent, ExxonMobil’s by 56 percent, and Shell’s by 50 percent. In December 2019, Chevron was forced to write off $10 billion in losses.

Global indexes measuring the value of the largest oil companies hit a 50-year low in 2018; of the world’s 100 biggest stocks, only six were oil producers. By 2019, the fossil fuel industry ranked dead last among major investment sectors in the United States. This was not surprising, given that the US oil and gas industry was in debt to the tune of $200 billion, largely because of struggling small fracking companies.

Even as investors were abandoning oil company stocks, a flood of cheap money and easy credit had been keeping the industry afloat. During the past decade, the US fracking industry lost $300 billion yet was able to continue producing, thanks to the financial backing of government subsidies, banks, hedge funds, and other investors. But well before the pandemic arrived, the private-capital flows were weakening. In addition, every major Democratic candidate for president pledged to end government subsidies for fossil fuels. Painting an ominous picture for the Wall Street Journal in 2019, Raoul LeBlanc of IHS Markit said that oil companies “don’t have the ability to borrow anymore.”

The loss of investor confidence was also a result of global activism. Nearly a decade of organizing around the demand that major institutions divest themselves of fossil fuel stocks had resulted in an estimated $11 trillion worth of commitments to sell off oil, gas, and coal holdings by late 2019. The divestment effort spawned a sister movement calling on banks and hedge funds to stop financing fossil fuel projects. “It’s been critical for Black people, Indigenous people, and people of color to stop the money pipeline,” says Reverend Lennox Yearwood Jr., president of the Hip Hop Caucus. These financiers, he argues, “would rather invest in our destruction, in our genocide, than in our lives and our future.” After spending trillions propping up the industry, most major North American and European banks decreased their funding for fossil fuels between 2017 and 2018.

As their fortunes diminished, oil and gas companies and many oil-producing countries tried to drill their way out of financial crisis. To pay back lenders and stockholders—or, in the case of state-owned companies, to generate the income for government budgets—producers kept pumping oil. But recall that in the midst of overproduction, both the price of oil and demand growth had been dropping, creating a vicious cycle in which producers had to sell more oil to make the same or even less money.

Oil production rose globally, but most aggressively in the United States. After production fell in the last year of the Obama administration, Trump’s “American energy dominance” policy spurred a historic ramp-up. US oil production reached its highest levels in history in 2018, and again in 2019. The boom made the United States the world’s largest oil producer and drove production across the nation, with states including Colorado, New Mexico, North Dakota, Ohio, Oklahoma, and Texas all reaching record highs.

A massive oversupply, a slew of indebted and overleveraged companies, wary investors, and a hostile public: All of the signs were there of a bubble ready to burst. In an October 2019 commentary for Bloomberg, Noah Smith, a leading energy analyst and finance professor, declared, “The age of oil is coming to a close.”

Click here to learn how COVID-19 relief programs designed to help families are directing billions of dollars toward propping up the oil industry.

The COVID-19 pandemic has brought into sharp relief the existing fragilities within the oil industry—and then made each of them worse. The pandemic has also revealed new ways that oil harms the public, as studies confirm that exposure to air pollution generated largely from fuel combustion from cars, refineries, and power plants increases COVID-19 death rates and that climate change (caused by the production and use of oil and other fossil fuels) is making outbreaks of infectious diseases more common and more dangerous.

As the pandemic took hold, governments around the world implemented stay-at-home orders. People delighted in the newly clean air as airplanes, trucks, trains, and cars went idle. Consumption of fossil fuels, especially gasoline, collapsed, and with it the price of oil.

The world’s leading petrostates took advantage of the moment to ensure their own survival. In March, US oil production increased even as Saudi Arabia and Russia entered into a price war that pushed the price of oil down even further. In April, President Trump met with US oil companies and then separately and individually with President Vladimir Putin of Russia and Saudi Arabia’s Crown Prince Mohammed bin Salman. Shortly thereafter, OPEC+ (the Organization of Petroleum Exporting Countries plus Russia, Bahrain, Mexico, and another half dozen producers) reached a global agreement to cut oil supply. But the OPEC+ production cuts wouldn’t take effect until May, and, in the short term, oil production in many countries surged. The geopolitical and corporate machinations provide a stark demonstration of how, even when faced with the worst possible scenarios for demand, supply, and price, the oil industry simply will not stop drilling unless it is forced to do so.

The oil glut quickly became a tsunami. Under the weight of all that oil, in April the price of oil crashed to negative $40 dollars a barrel—the lowest amount in history. Yet even at that bargain-basement price, there were few takers. Panic jolted the industry. The state of Oklahoma pronounced oil to be “economic waste.” Texas briefly considered mandating production quotas. From deep inside the heart of the US fracking boom, the Bismarck Tribune editorial board declared, “North Dakota must wean itself from oil dependence.”

OPEC, Russia, and other supplier nations did finally begin to hold back oil production. By June, global oil supply had fallen by some 12 million barrels a day (nearly 13 percent). But demand had plunged by more than twice that amount, or nearly 30 million barrels. In the United States, the frackers finally caved: Production fell by 3 million barrels a day in May, with virtually all the reductions coming from the shale—or fracking—regions of the country. In Colorado, oil production in April was just one-sixth of the volume in March. In North Dakota, production fell by 17 percent in that March-to-April period. Not only have some existing wells been closed in; fewer new ones are being drilled as well. There were just 10 rigs in North Dakota fracking new wells in June versus 61 the year before.

The fall in new drilling led to a collapse in jobs. Across the United States, more than 100,000 oil and gas and associated industry jobs were lost between March and May.

While the production slowdown by the OPEC+ nations is a temporary agreement, oil analysts Casey Merriman and Abhi Rajendran of Energy Intelligence expect a good deal of the US oil production cuts to be permanent. They predict that the country has reached peak oil production and will never return to the record 13 million barrels of oil per day reached in November 2019. COVID-19 has sped up a process already well underway, the analysts contend: Oil basins in the United States outside the Bakken Formation in North Dakota and the Texas–New Mexico Permian are turning into permanent “fringe” basins. In an astounding prediction, they argue that “geologic consolidation” will now take place, with US oil production shrinking—though not ending—everywhere other than the Permian, with production concentrating in the hands of the biggest players (see “A Long Sunset”).

Big Oil, Russia, and Saudi Arabia seem to have scored at least one win. The price of oil increased from negative $40 a barrel in April to around $40 a barrel by summer. Those prices mean more income, but not enough (in the absence of external financial backing) to prop up smaller fracking companies, whose break-even price per barrel is closer to $50. Many are already declaring bankruptcy. This is good news for the largest oil companies, including ExxonMobil, Chevron, and Shell. Each partners regularly with the members of OPEC and Russia, and they have long shared the goal of burying the smaller frackers, blamed for unfettered (and unstoppable) oversupply. The oil majors were late to join the shale revolution, and they have spent years trying to buy up and push out smaller rivals, especially in the Permian Basin. Now COVID-19 appears to have provided the opening they’ve sought.

But these newfound advantages for the majors represent a minor victory in a losing effort and are simply not enough to halt these companies’ own downward slides. In June, Moody’s predicted that global oil demand may have peaked in 2019. Shell announced that it will slash up to $22 billion from the value of its assets, and BP is selling assets worth $15 billion, including its petrochemical business, and eliminating 10,000 jobs worldwide. Chevron is cutting about 6,000 workers worldwide, and ExxonMobil, after taking a $3 billion write-down in May, announced that it could drop as many as 7,500 workers in the United States alone. They join some 55 oil companies that have announced plans to cut more than $37 billion from their pre-COVID 2020 spending budgets.

“The energy industry that emerges from the crisis will be significantly different from the one before,” argued the International Energy Agency in May, before making an aggressive pitch for a “once-in-a-lifetime opportunity” for governments worldwide to reboot their economies with $3 trillion in investments that will move us away from fossil fuels and toward “a more resilient and cleaner-energy future.”

“HISTORICALLY, pandemics have forced humans to break with the past and imagine their world anew,” the novelist and essayist Arundhati Roy wrote in April. “This one is no different. It is a portal, a gateway between one world and the next.” One month later, she joined with author Naomi Klein to launch a Global Green New Deal.

We live in a world that remains hardwired to oil. Now the oil industry is balanced on a precipice. Whether it survives the COVID-19 pandemic rests with public will and government policy: Will countries remain stuck within the oil era or move into a less volatile and more sustainable future? As goes the price of oil, so too goes the global economy—and we’re dangerously close to repeating the mistakes that led to the 2008 global financial crisis. Then, the price of oil skyrocketed to almost $150 a barrel, crushing consumers and consumer nations. Today, the collapse in oil prices has pulled producers and poor producer nations down with it. To save ourselves, we must unwind from oil.

Clearly, leaving Donald Trump, Vladimir Putin, and Mohammed bin Salman in charge of a global solution is a sure way to lock in a world order tied to oil. The extent to which governments are already stepping in to provide the capital that is otherwise draining from the industry is a testament to Big Oil’s remaining political prowess. Led by President Trump and Republicans in Congress, oil and gas companies in the United States had, by June, received billions of dollars in both direct federal COVID-19 benefits and indirect payouts through new Federal Reserve pandemic-relief spending, according to my own calculations for Sierra.

But there are alternatives that take us in another direction: actions and policies to rapidly transition away from fossil fuels and over to a just, equitable, and sustainable economy based on localized renewable energy sources and sustainable transportation systems.

First, we must acknowledge that falling demand and decreasing prices will not be enough to bring about a transition away from oil. Although Energy Intelligence analysts predict that the United States has reached its peak of oil production, their projections anticipate that some 10 million barrels of oil a day could be produced here through 2040. This amount is incompatible with the needs of social justice and public health, the Paris Agreement, and the goal of keeping average global temperatures from rising beyond 1.5 degrees Celsius.

To lock in the production cuts that have already been implemented and go beyond them requires keep-it-in-the-ground policies that are based on a “managed decline” in oil production. On the global level, turning away from oil will require wealthy countries to meet their obligations under the Paris Agreement and provide $500 billion by 2025 to support poorer countries’ transition to green, sustainable economies. These funds can be increased and should include targeted support for efforts in poor countries to keep their oil in the ground. The International Monetary Fund can help by expanding its recent decision to provide debt relief to struggling nations.

In the journal Climate Policy, Sivan Kartha, co-leader of the Stockholm Environment Institute’s Gender and Social Equality Programme, and Greg Muttitt, former research director of Oil Change International, recently laid out a path for a managed phaseout of fossil fuel extraction centered on equity and climate justice. The phaseout would begin in those communities—most typically communities of color—that disproportionately suffer the harms of extraction without the benefits. Also, wealthier, more diversified economies—led by the United States, Canada, and the UK—in which the social and economic costs of shuttering fossil fuel sectors are the least, would act most swiftly while simultaneously assisting poorer countries in their transition.

There are also many ideas for how the United States can disentangle itself from the power of the oil industry. The Freedom From Fossil Fuels platform—crafted by Governor Jay Inslee of Washington State and later adopted by Senator Elizabeth Warren—and its plans for securing environmental and climate justice (combined with the Frontlines Climate Justice Executive Action Platform from the progressive think tank Demos) may provide the most comprehensive road map for navigating a managed decline. The Freedom platform includes banning all new fossil fuel leasing on federal lands and offshore waters; ending government subsidies for fossil fuels; banning fracking; and tightening regulatory controls such that public health and safety and environmental protection are prioritized over fossil fuel production.

Going further, increasingly popular plans for local and national Green New Deals and global green stimulus packages will ensure the necessary government support for transitioning oil-dependent workers to well-paying, unionized green-energy jobs. For example, the government could provide financial support for or hire oil and gas workers to shut in and clean up abandoned wells, and oil and gas pipeline workers—whose skills are agnostic as to what flows through the pipes—could rebuild and maintain failing water and sewage lines. At the same time, more people are supporting the ongoing efforts of frontline communities, particularly Indigenous peoples, to defend their lands from fossil fuel operations.

The pandemic has made painfully clear that there are two ways the age of oil might end. There’s the status quo path, in which we are so overcome by the disasters brought about by our oil reliance—calamities in the forms of war, political upheaval, and the climate catastrophes of worsening drought, floods, hurricanes, fires, and disease—that we are unable to consume oil. And there is a more intentional, thoughtful path, one that embraces justice, equity, and sustainability. If we take that route, the “end of oil” will be a commitment to live in peace with one another and the planet.

The choice is up to us.

This article appeared in the September/October 2020 edition with the headline "The End of Oil?"

This article was funded by the Sierra Club Foundation.

This tanker invasion is only one piece of a dangerous buildup in oil supply that is the result of an unprecedented global glut. The coronavirus pandemic has gutted demand, resulting in the current surplus, but it merely exacerbated a problem that’s been plaguing the oil industry for years: the incessant overproduction of a product that the world is desperately trying to wean itself from, with growing success.

This tanker invasion is only one piece of a dangerous buildup in oil supply that is the result of an unprecedented global glut. The coronavirus pandemic has gutted demand, resulting in the current surplus, but it merely exacerbated a problem that’s been plaguing the oil industry for years: the incessant overproduction of a product that the world is desperately trying to wean itself from, with growing success.