Thursday, September 19, 2019

Economy faces risks, not recession: Bernanke

https://www.reuters.com/article/us-usa-bernanke/economy-faces-risks-not-recession-bernanke-idUSWBT00789120071108

WASHINGTON (Reuters) - Federal Reserve Chairman Ben Bernanke told lawmakers on Thursday the U.S. economy did not appear headed for recession, but warned growth could prove weaker than expected and inflation higher.

Wednesday, August 7, 2019

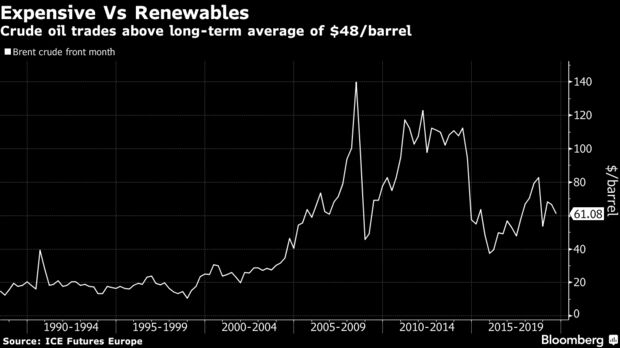

Oil Needs to Fall Below $20 to Compete With Green Alternatives

Wind and solar power can produce seven times more useful energy for cars, dollar for dollar, than gasoline with oil prices near current levels, according to BNP Paribas SA.

Oil will have fall to $9-$10 a barrel in the long-term in order for gasoline cars to remain competitive with clean-powered electric vehicles, and to $17-$19 a barrel for diesel, Mark Lewis, global head of sustainability research at BNP’s asset management unit, said in a research report. U.S. benchmark crude was trading at about $55 in New York on Monday.

“Our analysis leads to a very stark conclusion for the oil industry: for the same capital outlay today, wind and solar energy will already produce much more useful energy for EVs than will oil purchased on the spot market,” Lewis said. “These are stunning numbers, and they suggest that the economics of renewables in tandem with EVs are set to become irresistible over the next decade.”

Stark Numbers

Energy return on capital invested

Note: Energy return from new renewables projects in tandem with EVs, versus oil used for gasoline vehicles for a $100b outlay -- in TWh

Lewis coined the term “energy return on capital invested” to explain the economics of road transport. It’s a measure of the money spent on oil and renewables and the differential in their net energy produced when used to provide mobility, he said.

Still, changes will take time.

“The oil industry today enjoys a massive scale advantage over wind and solar of several orders of magnitude – oil supplied 33% of global energy in 2018 compared with only 3% from wind and solar,” Lewis said.

Higher carbon prices applied in more places around the world would improve the chance of meeting the emission targets implied in the Paris climate deal struck in 2015, Lewis said.

Germany is among nations considering including carbon pricing in its transport sector, something California already does.

(Updates with comment on carbon in penultimate paragraph.)

Monday, July 15, 2019

The Agony of Hope Postponed, by a Value Investor

https://www.wsj.com/articles/the-agony-of-hope-postponed-by-a-value-investor-11563109380

Value investors are known for being a hardy bunch, willing to buy into beaten-down stocks that everyone else thinks are a disaster. But cheap stocks have underperformed horribly over the past 12 years, and even some fund managers who specialize in buying them wonder in private if the technique no longer works. Could value be dead?

I’m a natural value guy, and not just in stocks. I like bargains, and will trek across town—or to today’s equivalent, the third page of the search engine—to find them. Over the long run of history, bargain hunting in stocks has won out, by a lot. So before paying up to buy expensive stocks on the grounds they will get even more expensive, I want to know why this time is different.

The dire years have produced plenty of theories for why value hasn’t worked of late. Perhaps markets are more efficient than they used to be, as algorithms take the emotion out of investing. Perhaps the rise of capital-light companies means traditional value metrics such as price-to-book don’t work any more. Or perhaps superlow interest rates favor fast-growing companies, and so punish struggling value stocks, which tend not to have a convincing story to tell about the future. Value investors often argue that the poor performance is just one of those things that has to happen from time to time, because if it was easy, everyone would do it.

SHARE YOUR THOUGHTS

How much longer do you think stocks will fall on good economic news? Join the conversation below.

The investors who picked the expensive growth companies in the past decade got it right. They frequently claim that this time it really is different. The new technologies that traded at high multiples of book value, of earnings, and of sales, showed themselves worthy. Companies such as Apple Inc., Microsoft Corp. , AlphabetInc. and Facebook Inc. have grown to become the biggest stocks in the world by making a ton of money.

One firm that uses value among several approaches to investment thinks we’ve seen this before—the last time a major disruptive technology caught on.

The 1920s and 1930s for investors bring to mind the 1929 stock-market crash. Chris Meredith at Stamford, Conn.-based O’Shaughnessy Asset Management points out it was also the period when the automobile shifted from early takeup to widespread deployment, bringing mass production and distribution of consumer goods.

General Motors and the Standard Oil companies were the leading stock-market disrupters of the time, trading at valuation premiums to “old” industries such as steam-driven railroads, utilities and shipbuilding. Their disruption looks very like today’s: the period from 1926 to the late U.S. entry into World War II in 1941 was the last time value underperformed for as long as it has since its June 2007 high. Data from Prof. Kenneth French at Dartmouth’s Tuck School of Business shows value stocks have lagged behind on average 5 percentage points a year behind growth stocks since then, just worse than the same period up to the summer of 1939.

Mr. Meredith uses the framework developed by academic Carlota Perez, which shows how previous technological revolutions followed similar patterns of boom and bust, then a multiyear intermediate phase when the winners are established, before maturity. The internet age only really reached this intermediate phase with the development of the iPhone, launched in 2007 just as the financial crisis was starting.

From 1926 to the war, the cheap value portfolio is crammed with utilities, the stocks that had led the electrification revolution but had become mature and dull. The go-go growth stocks were in manufacturing, with few of them cheap enough for value buyers to pick.

There’s a similar industry bias today: value has heavy exposure to banks and other financial stocks, which helped it outperform before the crisis but dragged it down since. This time, the go-go growth stocks are mostly in the technology sector (although Amazon is a retailer), where value has little exposure.

Value investors clutching at straws might hope that the online takeover is virtually complete, with the internet giants moving into the “synergy” phase where the new technologies boost the economy, while the excitement they once generated wears off. Meanwhile, old industries might start to benefit by adopting parts of the new technologies, just as beaten-up coal railroads became stock-market winners when they shifted to diesel trains.

I find the historical comparison compelling. But it isn’t so obvious that we’re at the end of the internet disruption yet. The big shift that allowed value to start performing again after World War II was that the disruption was done, and the old industries had vanished or adjusted to cope.

It’s true that music retailers have gone the way of horse-drawn transport, and the bookshops that are left have shaken up their business models. There are also signs of the tech giants competing with each other, not just gobbling up old industries, such as Amazon’s entry into advertising. Many old-tech business models have changed, too, to fit better in a world of online competition; meanwhile governments are under pressure to rein in or tax the big tech winners. Against that, the big tech companies are investing heavily in technologies that could disrupt yet more industries.

What keeps me clinging on to the value creed is that all of this is priced in, and then some. Back in 2007 value stocks had had a great run, and were less of a bargain compared with growth stocks than any time since the mid-1980s, according to Vitali Kalesnik, director of research for Europe at Research Affiliates. They are now much cheaper than usual compared with growth stocks (although the gap was bigger still in the dot-com bubble), so there’s a better chance that the bad news is already recognized.

Write to James Mackintosh at James.Mackintosh@wsj.com

Subscribe to:

Comments (Atom)